by Jamie Redman

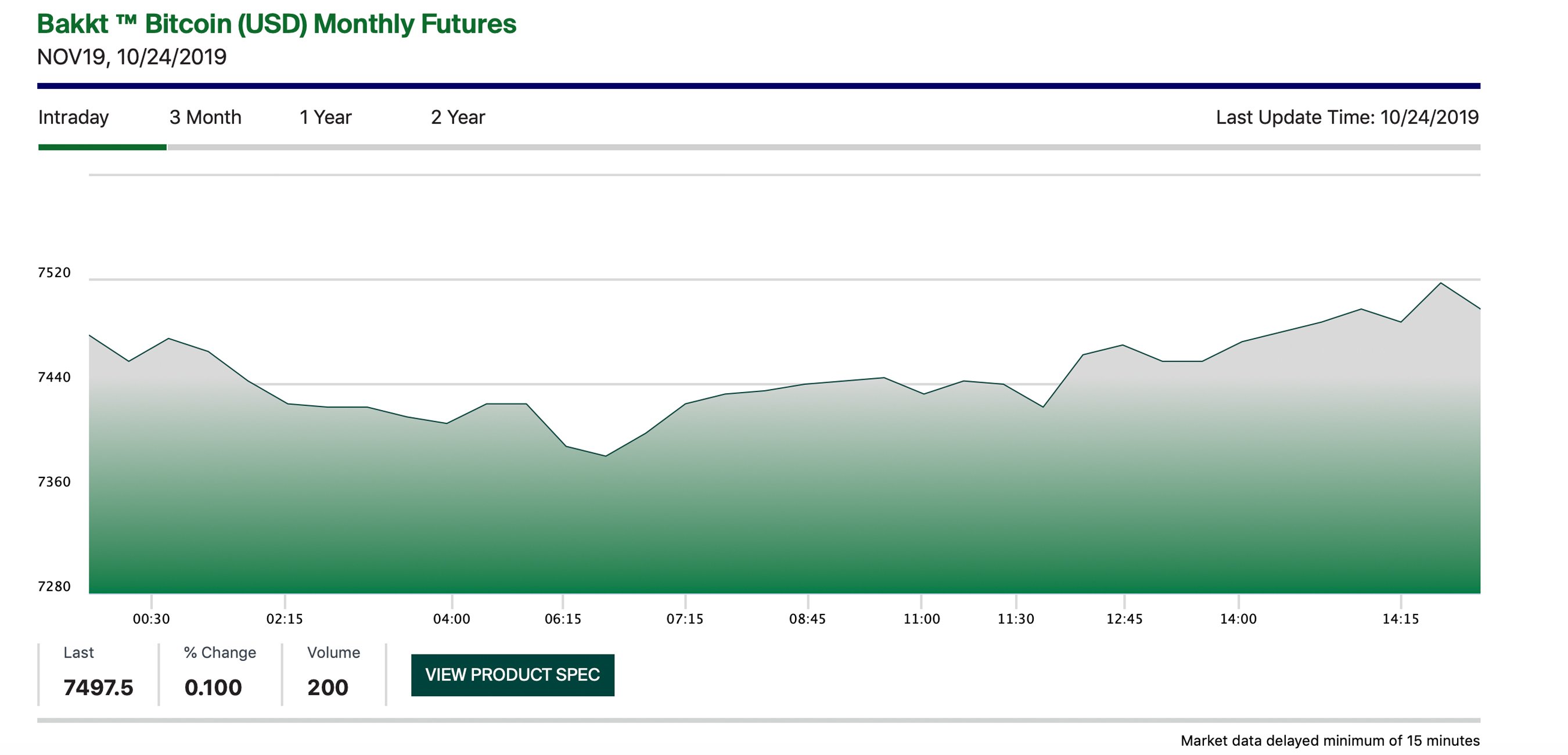

On October 23, Bakkt’s physically-settled bitcoin futures contracts touched an all-time high with 640 BTC ($4.8 million) swapped on the exchange. Coincidentally, the futures action started after BTC prices plummeted to $7,365 across global exchanges. After the record-setting day, Bakkt CEO Kelly Loeffler revealed the trading platform will offer options on bitcoin futures this December.

Also read: CME Bitcoin Futures Sees Institutional Interest and Demand from Asia

Bakkt’s Bitcoin Futures See Another Record-Setting Day After BTC Plummets

Digital currency markets saw deep losses on Wednesday when BTC and many other cryptocurrency prices dropped like a rock in less than 15 minutes. In one day, roughly $11 billion was shaved off the market cap of all 2,000+ cryptocurrency markets. There’s been a lot of speculation as to why prices have been so volatile, but significant liquidations on popular leverage markets like Okex, Bitfinex, and Bitmex show traders are being rinsed out like a wet rag. Additionally, people have been focused on Bakkt’s physically-settled bitcoin futures markets, which have spiked considerably during every BTC price dump. The first drop in BTC was on October 10 when prices dipped from $8,600 to $8,200. As it happened, Bakkt’s futures volumes jumped at the same time after a sluggish week. Bakkt saw its first block trade and a 796% rise in trade volume in one day.

Speculators believe that Bakkt’s physically-settled bitcoin futures are slowly bringing a new type of price discovery to the crypto market. Bakkt CEO Kelly Loeffler explained after the record volumes on October 10 that “Much like cotton and coffee futures contracts that can go to physical delivery, many of the same processes apply to the Bakkt Bitcoin Futures.” Loeffler believes it is the “dawn of a new asset class” and since then the derivatives products have gained a lot more traction. This week followed the same pattern as crypto enthusiasts and traders witnessed BTC drop in value, losing 7% in a flash. Concurrently on Wednesday, Bakkt’s futures spiked to 640 BTC from a mere 85 BTC the day before. The new action has been growing after Bakkt’s first week was extremely lackluster compared to CME’s cash-settled BTC futures and an hour’s worth of Bitmex volume.

Bakkt to Introduce Bitcoin Options on Futures on December 9

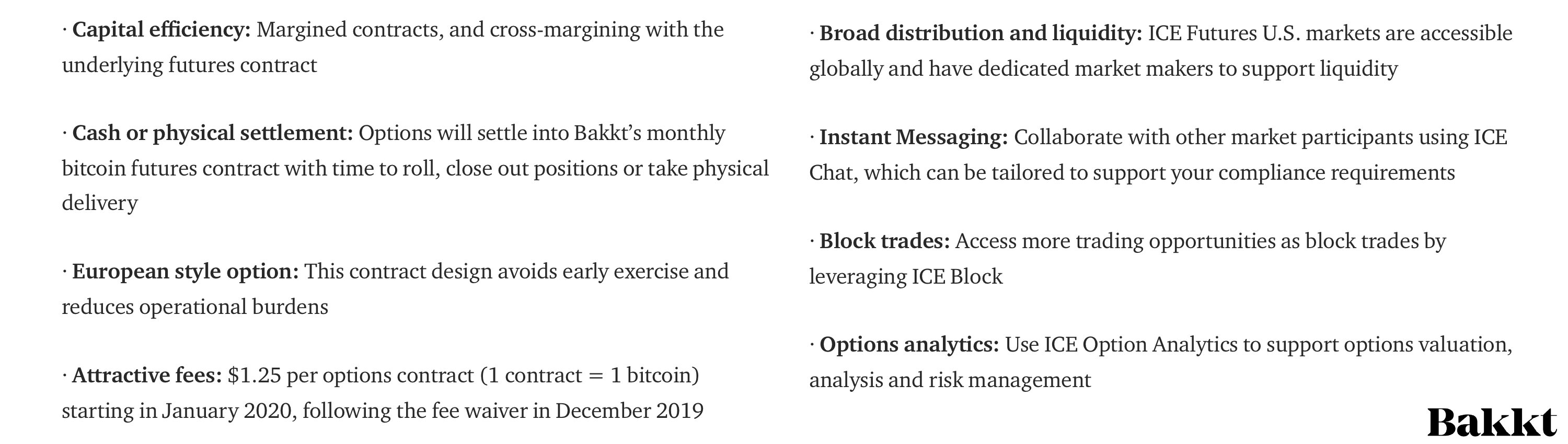

Following the massive spike, Loeffler wrote the public again to say that a new BTC derivatives product is coming at the end of Q4. Bakkt plans to launch the first regulated options contract for bitcoin futures on December 9. “The Bakkt Bitcoin Options contract will be based on the benchmark Bakkt Monthly Bitcoin Futures contract and represents another important step in developing this asset class for institutional investors, their customers, and investors,” Loeffler said. Similarly to CME Group’s recent BTC options announcement, Loeffler detailed that the reason the firm is developing the new product stems from “customer feedback.” “[The Bakkt Bitcoin Options contract] is designed to hedge or gain bitcoin exposure, generate income, and offer cost and capital efficiencies,” she added. Loeffler disclosed that ICE has self-certified the contract with the CFTC and the firm is looking forward to launching the new product.

Loeffler stated that the new options will offer margined contracts, and cross-margining and cash or physical settlement. Bakkt clients will benefit from the European style option, block trades, and options analytics. “Since launching the Bakkt Bitcoin Futures just one month ago, we’ve been working closely with market participants to build liquidity, create market transparency and build open interest,” Loeffler emphasized. The Bakkt executive added:

Bakkt Bitcoin Futures have tight bid-ask spreads throughout U.S., European and Asian trading hours, and we continue to onboard new institutional and retail customers.

What do you think about Bakkt’s recent spike in BTC futures volume and the options product being introduced? Let us know what you think about this subject in the comments section below.

Image credits: Shutterstock, Medium, Bakkt, and Pixabay.